If you’ve been injured in an accident and received medical care before your case settled, you may encounter a term that can directly affect your payout — the medical lien. Essentially, this is a legal right that allows healthcare providers or insurers to get reimbursed for the cost of your treatment from your settlement proceeds.

While the concept is straightforward, liens can take various forms depending on who paid for your care. Different types of liens—such as hospital, physician, insurer, workers’ compensation, or government programs like Medicaid and Medicare—follow varying rules and timelines.

When liens aren’t identified and handled early, they can shrink your net recovery, slow down negotiations, or lead to unnecessary legal disputes.

Here, we break down exactly what a medical lien is, how it works in personal injury cases, why it matters for both patients and providers, and what steps you can take to protect your settlement.

Understanding Medical Liens

What Is a Medical Lien?

A medical lien is a legal claim placed against a personal injury settlement or judgment to ensure a healthcare provider or insurer is reimbursed for medical services rendered. This allows injured parties to receive necessary treatment without paying up front, with the understanding that payment will be made from the settlement funds.

For example, if you receive treatment after a car accident but cannot pay immediately, the hospital may file a lien against your eventual settlement. This ensures they get paid once your case resolves.

How Do Medical Liens Work?

When a lien is filed, it’s recorded with the court or sent to your attorney and insurance company. Once your settlement is reached, the lien holder receives payment before you receive the remaining balance.

This process can vary based on state laws, the type of lien, and the specific agreements you’ve signed with healthcare providers.

Why Are Medical Liens Filed?

Medical liens are filed to secure payment for services already provided. Without them, providers risk not getting paid if a settlement amount is too low or the injured party refuses payment.

In many personal injury cases, medical liens enable injured individuals to access care they couldn’t otherwise afford, acting as a form of medical lien funding until the case is resolved.

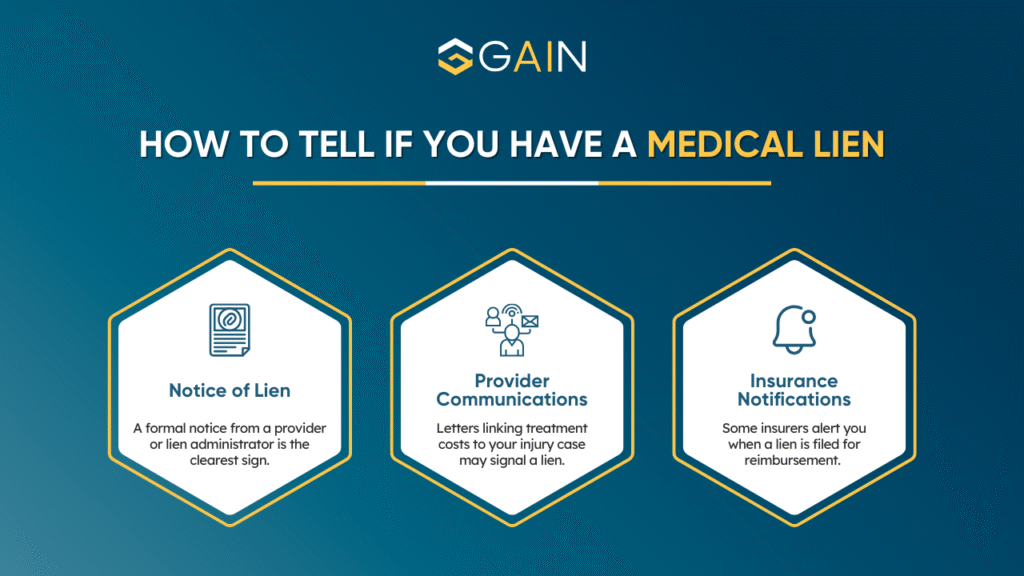

How to Determine If You Have a Medical Lien

Sometimes, a lien exists without the patient realizing it until settlement negotiations begin. Recognizing the signs early allows you to address the lien before it delays your case.

Common signs that a medical lien has been filed include:

- Receiving a Notice of Lien – A notice is the most direct sign that the healthcare provider’s billing department or a third-party lien administrator has filed a lien against your case.

- Communications From a Healthcare Provider – If you receive follow-up letters about payment that reference your pending personal injury case, it could indicate a lien.

- Notifications From Your Insurance Company – Some insurers notify policyholders when a lien has been filed, especially if they have a reimbursement right under the policy.

Reviewing Medical and Insurance Documentation

Regularly review medical bills, insurance correspondence, and any letters from attorneys to spot lien-related language.

This proactive approach aligns with lien management best practices and can help prevent last-minute surprises during settlement.

Consulting with Legal Professionals

If you suspect or have confirmed a lien, consult an attorney familiar with medical liens in personal injury cases.

They can verify its validity, negotiate its amount, or even challenge it if it is improperly filed. This step is critical, as improper handling can reduce your net recovery or extend settlement timelines.

Types of Medical Liens

1. Health Insurance Liens

When a health insurer pays for accident-related treatment, it may place a lien on your settlement to recover those costs.

This is common in both private insurance and government programs like Medicaid or Medicare. (Refer to the CMS lien recovery process for reference.)

2. Workers’ Compensation Liens

If your injury occurred on the job, workers’ compensation insurance may cover your medical expenses.

In return, they can file a lien against your personal injury settlement if another party is found liable.

3. Hospital and Physician Liens

Many states allow hospitals and individual doctors to file liens directly for unpaid treatment costs.

These liens can apply even when you have health insurance if the provider chooses to pursue direct reimbursement from settlement proceeds.

Legal and Financial Implications

Impact on Personal Injury Settlements

A medical lien can significantly reduce your net settlement because lien holders collect their payment before you receive any funds.

For example, if you settle for $100,000 and have a $30,000 lien, the provider or insurer gets their portion first, leaving you with less compensation for other damages.

This is why many attorneys strategically negotiate liens alongside settlement talks.

In fact, integrating lien resolution into broader revenue cycle management for personal injury cases can help law firms reduce lien amounts, improve payout timelines, and protect client settlements without delaying case closure.

Obligations to Satisfy the Lien

Legally, you are obligated to pay a valid medical lien out of your settlement or judgment. Failing to do so can lead to:

- Court enforcement actions

- Interest accrual on the lien amount

- Legal claims against you or your attorney

Federal programs like Medicare have particularly strict recovery rights under the Medicare Secondary Payer Act, which can impose double damages if liens go unpaid.

Consequences of Ignoring a Medical Lien

In certain cases, state laws allow lien holders to garnish future awards or settlements until their claim is paid.

Ignoring a lien can halt your settlement disbursement entirely, as most attorneys will not release funds until all liens have been satisfied. It can also result in lawsuits from lien holders and negative impacts on your credit if the debt is reported to collections.

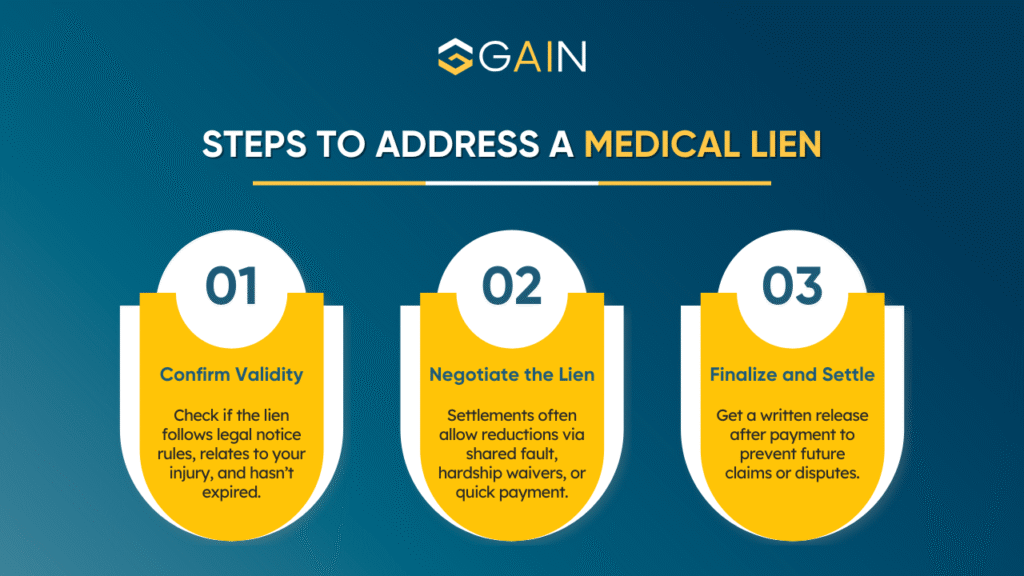

Steps to Address a Medical Lien

Confirming the Validity of a Lien

Not all liens are valid. You or your attorney should:

- Verify that the lien holder followed all state and federal notice requirements.

- Ensure the charges are related to your injury and not unrelated treatment.

- Check for expired claims—some states impose strict timelines for filing liens.

Negotiating a Medical Lien

Negotiation is often possible, especially if the settlement amount is less than the total damages. Attorneys may use arguments such as:

- Proportional reduction due to shared fault in the accident

- Waivers for financial hardship

- Discounts for prompt payment

According to the National Consumer Law Center, negotiated reductions can often save injured parties 10–30% of the lien amount.

Resolving and Settling a Medical Lien

As soon as an agreement is reached, ensure the lien holder issues a written release confirming payment and closure of the claim. This prevents future disputes and protects your settlement from additional deductions.

Many law firms integrate this step into their final settlement checklist to ensure compliance and avoid reopening cases due to unresolved liens.

Prevention and Management

Keeping Accurate Records

Keeping meticulous documentation is one of the most effective ways to prevent disputes over medical liens. Maintain copies of all medical bills, insurance correspondence, lien notices, and settlement communications.

When every expense and payment is recorded, it becomes easier to confirm lien validity and negotiate adjustments.

Communicating with Healthcare Providers

Similarly, regular communication with your healthcare providers can help you stay informed about outstanding balances and any liens filed.

By confirming charges early and requesting itemized statements, you can avoid inflated lien amounts and spot billing errors. Providers are often more willing to discuss flexible repayment terms or lien reductions when they see proactive engagement.

Legal Assistance and Representation

Experienced legal counsel can be a decisive factor in successfully managing a medical lien. At Gain Servicing, attorneys not only negotiate lien amounts but also ensure compliance with applicable state and federal laws. They can integrate lien handling into overall case strategy, ensuring that settlements reflect the full value of your claim while minimizing deductions.

Resources and Tools

Legal Aid Services

If you cannot afford private representation, nonprofit legal aid organizations often assist in understanding and resolving medical liens. Many operate under income-based eligibility criteria, and some specialize in personal injury or healthcare-related debt disputes.

Helpful Online Tools and Calculators

Several online calculators can estimate the potential impact of a medical lien on your settlement. These tools can help you plan negotiations and evaluate whether proposed reductions meaningfully improve your net recovery.

However, results should always be reviewed with a legal professional to account for jurisdiction-specific lien rules.

Financial Advisers and Consultants

Financial professionals familiar with personal injury settlements can help you understand the long-term effects of a lien on your finances.

They can advise on structured settlements, tax implications, and debt management strategies, ensuring that you make informed decisions about your compensation.

Conclusion

Medical liens can directly influence how much you ultimately receive from a personal injury settlement. Understanding your rights, the lien process, and potential strategies for negotiation empowers you to protect your compensation.

The more informed you are, the better positioned you’ll be to navigate both the legal and financial aspects of lien resolution.

Seeking Professional Guidance

Ultimately, while it’s possible to handle a lien on your own, working with experienced attorneys or lien resolution specialists can save time, reduce stress, and improve your financial outcome.

They can identify opportunities to reduce lien amounts, ensure compliance with applicable laws, and safeguard your settlement from unnecessary deductions. For a deeper look at professional lien servicing strategies, explore how we process and continuously invest in the servicing of medical liens.

FAQs

What is a medical lien, and how does it relate to my healthcare expenses?

A medical lien is a legal claim that allows a healthcare provider or insurer to recover the cost of your treatment from any personal injury settlement you receive. This ensures they are reimbursed before you access the remaining funds.

How can I find out if I have a Medicaid lien?

You can request confirmation from your state’s Medicaid office or review any correspondence you’ve received from Medicaid after your injury claim. Many states also have online portals for checking lien status.

How do I remove a medical lien?

A lien can be removed by paying the outstanding amount, negotiating a reduced settlement, or proving that the lien was filed in error.

Your attorney can submit the necessary documentation to the lienholder and request a formal release.

How do I know if I owe Medicaid money?

If Medicaid has paid for your injury-related treatment, it may seek reimbursement from your settlement.

Check your Explanation of Benefits (EOB) statements and contact your state Medicaid agency to confirm any repayment obligations.

How long does a health insurance lien take?

Timelines vary, but most health insurance liens are resolved within a few weeks to several months after settlement, depending on the insurer’s internal processes and responsiveness.

How can I find out if a medical lien has been filed against me?

Review all legal and insurance correspondence, check your county’s public records, or ask your attorney to search for any liens filed in connection with your case.