You treat patients today. But the money? It may not appear for 6, 12, or even 18 months.

That’s the reality of lien-backed care in personal injury cases. High-value treatments get buried in receivables. Staff spend hours chasing law firms. And your revenue sits unseen, uncollected, and impossible to forecast.

For many practices, PI care under medical liens still makes strategic sense. These are high-margin cases in a reimbursement-starved market. But without the right systems in place, the operational chaos can outweigh the financial upside.

The question isn’t whether to treat on lien. It’s whether you can do it profitably and predictably—without chasing paper, stressing staff, or guessing at collections.

The Promise and Pain of Lien-Based Treatment

On the surface, lien-backed care looks like the best of both worlds—no insurance denials, full-fee reimbursements, and the chance to serve patients who truly need care.

But behind that promise is a quiet erosion of trust and cash flow. When reimbursement depends entirely on case resolution, it doesn’t matter how good your care was—payment can take months or even years to arrive.

In most PI cases, lien-backed payments aren’t made until the underlying claim is resolved—often months or even years after treatment—creating a prolonged gap between care delivered and payment received.

In a high-volume environment, even a few unresolved liens can strain cash flow and shake team confidence. The real pain isn’t just delayed revenue—it’s the invisible drag on your people, predictability, and long-term growth.

What’s Missing: Control and Visibility

It’s not the plaintiffs—or even the attorneys—holding back revenue from lien-based cases. The real culprit is a lack of real-time visibility and operational control.

Lien workflows are often scattered across spreadsheets, disconnected billing systems, and endless email threads. Intake happens in one place, billing in another, and legal updates get buried in inboxes. No one sees the full lifecycle of a lien-backed claim.

As a result:

- Manual tracking leads to missed deadlines, lost follow-ups, and incomplete documentation

- Fragmented systems create blind spots between medical, legal, and billing teams

- No status insight means zero predictability on payments

According to an issue brief published by the Federation of Defense & Corporate Counsel, these workflow challenges are happening in a broader market context that’s becoming even more complex. The growing role of medical funding companies in personal injury cases has added significant legal complexity for providers. In lien-based arrangements, treatment is often billed at elevated “litigation rates,” which can greatly exceed reasonable market value. These inflated charges, combined with over-treatment or overbilling in some cases, can drive up claimed damages and complicate negotiations. Providers and attorneys must then navigate multi-party settlements, lien negotiations, and shifting payment timelines—making operational visibility and control even more critical.

What starts as a systems issue becomes a growth problem. With the right infrastructure, lien-backed care can shift from unpredictable to strategic.

Lien-Backed Revenue Can Be Predictable—With the Right Systems in Place

You don’t need to work harder—you need better infrastructure.

The most successful practices aren’t doing more; they’re seeing more: which claims are nearing settlement, which attorneys are behind, and what’s collectible this month.

Here’s how they make lien revenue predictable:

Track every lien in real time—One dashboard. Every patient. Instant visibility into treatment status, attorney activity, and payment position.

Automate critical follow-ups—Alerts trigger exactly when to act—on lien letters, disbursements, or missing documents—so nothing slips through.

Tailor views to each role—CFOs see AR and velocity insights. Managers know which attorneys need escalation. Admins work from one synced platform.

The result? Less friction, faster collections, and revenue you can count on—not just hope for.

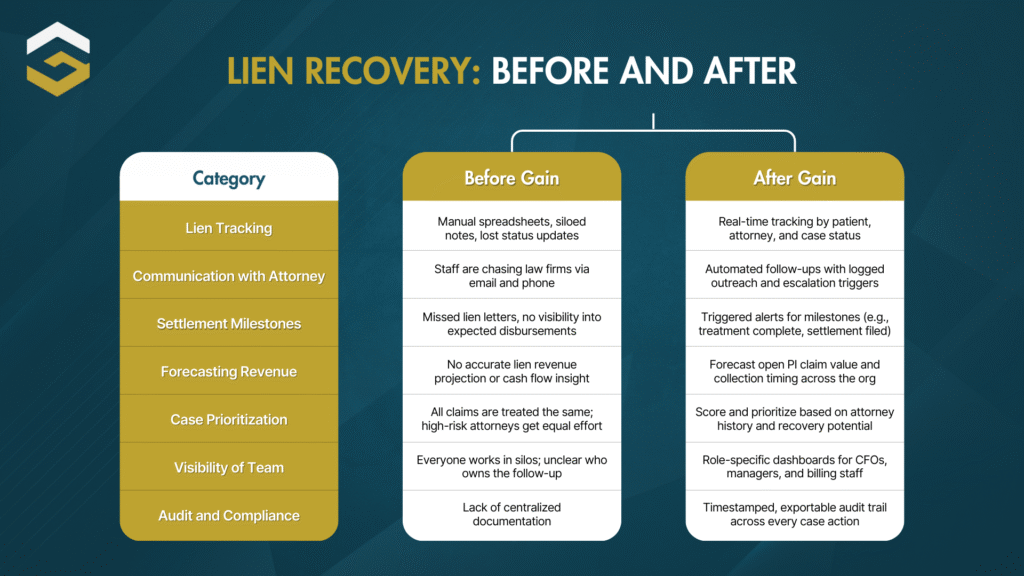

Before vs. After Gain

| Category | Before Gain | After Gain |

| Lien Tracking | Manual spreadsheets, siloed notes, lost updates | Real-time tracking by patient, attorney, and case status |

| Communication with Attorney | Staff chasing law firms via email/phone | Automated follow-ups with logged outreach and escalation triggers |

| Settlement Milestones | Missed lien letters, no visibility into disbursements | Alerts for milestones (e.g., treatment complete, settlement filed) |

| Forecasting Revenue | No accurate projections | Forecast open PI claim value and collection timing across the org |

| Case Prioritization | All claims treated equally | Score and prioritize by attorney history and recovery potential |

| Visibility of Team | Everyone works in silos | Role-specific dashboards for CFOs, managers, and billing staff |

| Audit and Compliance | No centralized documentation | Timestamped, exportable audit trail for every case action |

From intake to settlement, Gain brings structure and speed to every stage of lien servicing—helping provider groups unlock predictable, scalable PI revenue.

See how Gain helps provider groups unlock predictable, scalable PI revenue.

Building a Profitable Lien Strategy in 4 Steps

Transforming lien-backed care into a predictable revenue stream doesn’t require an operational overhaul—but it does require strategic focus in four key areas.

Step 1 – Centralize Your Med-Legal Billing Workflow

Unify intake, billing, and legal coordination so nothing falls through the cracks. Shared visibility reduces burnout and keeps high-value claims on track from Day 1.

Explore lien management best practices.

Step 2 – Score and Prioritize High-Value Cases

Not all PI cases are equal. Use historical data to score incoming cases, flag high-risk firms, and prioritize claims with the highest recovery potential.

See how leading PI firms turn overdue receivables into a revenue advantage.

Step 3 – Automate Follow-ups and Documentation

Automation keeps cases moving and compliance intact. Trigger reminders at key milestones, sequence attorney follow-ups, and maintain an audit trail for every action.

Learn how Gain’s workflows speed up collections.

Step 4 – Track Revenue Velocity in Real Time

Monitor days-to-payment by attorney, clinic, or treatment type. Forecast future income and pinpoint which referral sources help—or hurt—your margins.

Discover how to benchmark and improve your recovery velocity.[BM1]

Real-Time Control = Scalable Growth

The moment you can see what’s collectible and when, it changes how you run your practice.

Here’s what growth looks like with predictable lien revenue:

- Write-offs shrink because no case goes cold unnoticed

- Collections accelerate with automated workflows and attorney accountability

- Leadership makes informed decisions on staffing, service lines, and expansion

Book a walkthrough of the Gain platform.

Ready to Stop Leaving Lien Money on the Table?

Treating PI patients on a lien shouldn’t feel like gambling with your revenue.

With the right systems, you know when you’ll get paid—and can plan, grow, and reinvest accordingly.

Gain helps you:

- Track every open lien in real time

- Automate follow-ups and reduce manual admin

- Identify high-risk cases before they drain your AR

- Turn unpredictable payments into a steady revenue stream

Real-time control isn’t a nice-to-have—it’s the difference between surviving on uncertain payouts and growing on your terms.