Every PI CFO knows the headline figures—what’s billed, what’s outstanding. But here’s the question that truly determines your firm’s financial strength: how quickly are you converting medical liens into cash?

That metric is called recovery velocity, and it’s often the difference between growing sustainably—or getting stuck in a cash flow chokehold.

In this guide, we break down:

- What recovery velocity actually measures—and why it beats traditional AR reports

- The operational delays that quietly drag performance down

- A three-tier model to benchmark your firm

- Five tactical strategies used by the fastest-growing PI firms

If your team is stuck reacting to aged receivables instead of forecasting cash with confidence, this is your roadmap out.

What Is Recovery Velocity?

Recovery velocity measures the time it takes to collect on a medical lien—from the date of treatment or case opening to the final payment or disbursement.

It’s more precise than Days Sales Outstanding (DSO), which averages receivables across the firm and hides case-level issues. Velocity zeroes in on lien-level resolution speed, giving you visibility into bottlenecks, delays, and high-performing workflows.

In contingency-based practices, speed is leverage. The longer recovery takes, the longer capital is trapped—and the harder it is to:

- Pay medical providers on time

- Predict firm-wide revenue

- Maintain partner satisfaction

- Reinvest in business development, staffing, or technology

Slow velocity is a system-wide drag. Fast velocity compounds operational and financial gains.

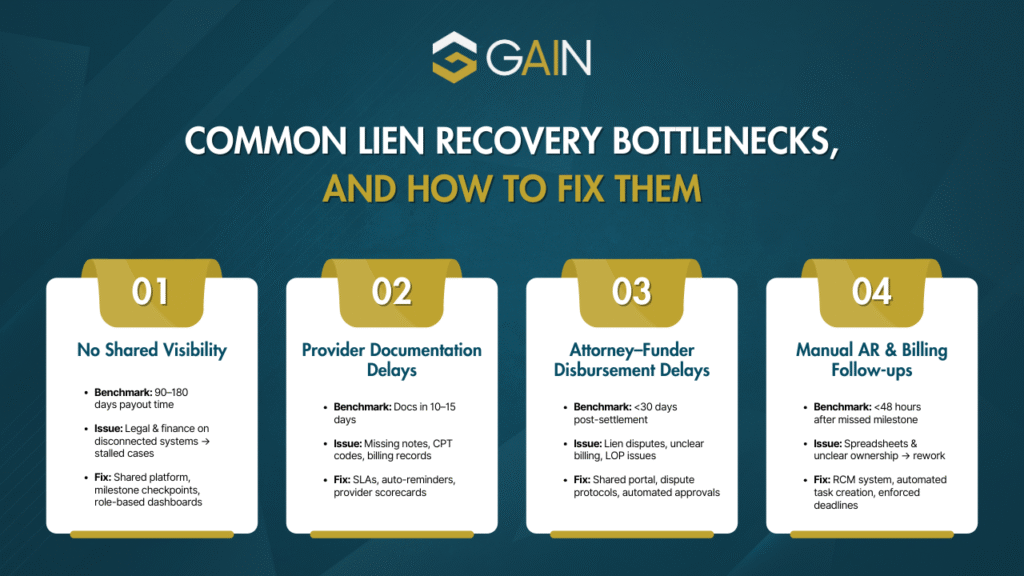

The Four Operational Bottlenecks That Stall Recovery

Even strong case outcomes can get stuck in collections limbo. Here are four critical points where delays occur—and how top firms resolve them:

1. No Shared Visibility Into Lien or Case Milestones

Common observation: Many firms see payouts occur within three to six months of treatment, but timelines vary widely based on case complexity and coordination between teams.

- Common breakdown: Legal and finance teams work in disconnected systems. Updates don’t flow between them, leaving cases idle for weeks after treatment.

- The fix:

- Implement a shared case management platform integrating lien servicing with legal milestones.

- Set mandatory update checkpoints at each milestone to trigger next steps automatically.

- Use role-based dashboards so legal assistants, finance, and lien servicing all operate off the same data.

2. Provider Documentation Delays

Common goal: Many high-performing PI firms aim for complete provider documentation within 10–15 days of treatment.

- Common breakdown: Medical providers fail to submit complete records—missing notes, CPT codes, or billing details stall lien validation.

- The fix:

- Build SLAs into med-legal partnerships with clear documentation timelines.

- Send automatic reminders at 7- and 14-day intervals post-treatment.

- Create provider performance scorecards to track timeliness, guiding referral volume and partnership decisions.

3. Attorney–Funder Disbursement Delays

Regulatory requirement: Medicare lien repayments must be completed within 60 days of settlement. Many PI settlements—where no disputes exist—are disbursed in roughly 4–6 weeks.

- Common breakdown: Lien disputes, unclear billing entries, or disagreements over LOPs hold up resolution.

- The fix:

- Use a shared disbursement portal with real-time visibility into billing, splits, and negotiation notes.

- Set predefined protocols for LOP validation and escalation.

- Automate approvals for common resolution patterns so minor disputes don’t stall full disbursement.

4. Manual AR and Billing Follow-ups

Best practice target: Follow-ups are ideally executed within 48 hours of missed milestones to prevent compounding delays.

- Common breakdown: Spreadsheets, scattered emails, and unclear ownership cause rework and missed steps.

- The fix:

- Transition to an RCM system with intelligent task routing and overdue alerts.

- Automate next-step tasks based on lien status.

- Require acknowledgment and completion within set timeframes to maintain accountability.

How to Benchmark Your Recovery Velocity

You can’t improve what you don’t track. While there’s no single “industry standard” for PI lien recovery timelines, we’ve observed the following ranges across the market. Use them as a reference point to identify where your firm sits today and where there’s room to accelerate:

| Tier | Avg. Recovery Time | Common Characteristics |

| Tier 1 | Under 120 days | Centralized case insight, synced providers, lien scoring in place |

| Tier 2 | 120–180 days | Partial visibility, some manual workflows, inconsistent provider documentation |

| Tier 3 | Over 180 days | Fragmented systems, siloed teams, aging AR, reactive follow-ups |

If you’re in Tier 3, you’re likely burning time, leaving revenue on the table, and increasing friction with both legal and medical stakeholders. The fastest-growing firms aim for Tier 1 timelines, but even incremental gains can significantly improve cash flow.

Five Tactical Levers to Improve Recovery Velocity

Leading firms don’t rely on lagging indicators like aging reports—they take a proactive, system-wide approach.

1. Centralize Lien and Legal Milestone Data

- Consolidate lien data with legal case stages in a single dashboard.

- Define clear status categories with ownership at each step.

- Automate alerts for missed SLA actions.

2. Set and Enforce Provider SLAs

- Contractually define documentation deadlines.

- Require document uploads through a centralized platform.

- Track adherence monthly and adjust referral volume accordingly.

3. Segment Claims by Type and Source

- Tag liens with source firm, claim type, provider, and documentation status.

- Identify slow-moving segments with weekly performance reports.

- Route flagged cases to specialized teams.

4. Trigger Alerts for At-Risk Liens

- Create triggers for inactivity, missing documentation, or unresolved disputes.

- Route flagged cases into a “Recovery Risk” queue for priority handling.

5. Use Predictive Scoring—Not Just Aging Buckets

- Score liens by treatment type, partner history, documentation status, and settlement stage.

- Use scores to forecast cash flow and set follow-up priorities.

What the Top 5% of Firms Do Differently

They don’t just track recovery, they forecast it:

Top PI firms treat recovery like a business unit—not a back-office function.

- Assign lien-level collection probability scores

- Use scores to guide follow-up, staffing, and projections

They track performance by team and handler:

- Know which attorney groups close liens on time—and which delay payout

- Review velocity metrics weekly, not quarterly

They benchmark across intake channels and providers:

- Track which partners cause disbursement delays

- Intervene early, adjust volume, and set clear expectations

They make velocity a shared KPI:

- Use scorecards tracking days-to-recover, on-time documentation rates, and settlement-to-disbursement timelines

They review velocity monthly:

- Treat it as an active metric

- Meet cross-functionally to address stalls and reallocate resources

Final Word: You Can’t Improve What You Don’t Measure

Aging reports tell you what’s late. Recovery velocity tells you why—and where to fix it.

Gain Servicing gives PI firms the tools to measure, benchmark, and improve every step of the recovery lifecycle. With the right systems, you can unlock faster cash, reduce risk, and scale without friction.

Ready to see how your firm stacks up?

[Book a 15-minute consult with Gain] to benchmark your recovery velocity and start your acceleration plan.